Travel insurance has saved a lot of situations and prevented many bad situations from becoming worst. It helps you recover from losses that you didn’t expect while planning a trip or your favorite vacation. In an uncertain world of travel, anything can happen, and it’s only wise to prepare upfront for the unforeseeable future.

This is why travel insurance is essential as it covers all the unexpected losses during your trips. In this post, we look at Allianz Travel Insurance and all you can get from it.

Allianz Travel Insurance is an insurance offered by Allianz Global Assistance. It is an insurance giant operating in 35 countries and serving 40 million customers in the United States alone for those unfamiliar with Allianz. Allianz offers different types of travel insurance plans depending on your needs.

When considering and planning a trip, it may be important to consider taking buying travel insurance so that you can stay safe and not worry about unforeseen events that could affect your vacation. Allianz Global Assistance offers many options to choose from.

We will evaluate the travel insurance plans provided by Allianz Global Assistance to help you decide if they are right for you.

Table of Contents

What plans does Allianz Travel Insurance offer?

Allianz offers many travel insurance options, so you decide which plan is right for you.

Allianz Travel Insurance: Single Trip Plans

Single trip plans are designed for those who are leaving their home, visiting another destination (or destinations), and already have in mind if and when they will return home. Allianz Global Assistance offers five travel insurance plans for single trips, including a plan focusing primarily on emergency medical coverage.

| Coverage | OneTrip Cancellation Plus | OneTrip Basic | OneTrip Prime | OneTrip Premier | OneTrip Emergency Medical |

|---|---|---|---|---|---|

| Trip Cancellation | $5.000 | $10.000 | $100.000 | $100.000 | |

| Trip Interruption | $5.000 | $10.000 | $150.000 | $150.000 | |

| Emergency Medical | $10.000 | $25.000 | $50.000 | $50.000 | |

| Emergency Medical Transportation | $50.000 | $500.000 | $1.000.000 | $250.000 | |

| Baggage Loss/Damage | $500 | $1.000 | $2.000 | $2.000 | |

| Baggage Delay | $200 | $300 | $600 | $750 | |

| Travel Delay | $150 | $300 | $800 | $1.600 | $1.000 |

| Daily limit | $150 | $150 | $200 | $200 | $200 |

| Travel Accident | $10.000 | ||||

| SmartBenefits | $100 | $100 | |||

| Change Fee Coverage | $500 | $500 | |||

| Loyalty Program Redeposit Fee Coverage | $500 | $500 | |||

| 24-Hr. Hotline Assistance | ✓ | ✓ | ✓ | ✓ | ✓ |

| Concierge | ✓ | ✓ | ✓ | ||

| Rental Car Damage Protector | optional | optional | |||

| Required to Work | optional | ||||

| Pre-Existing Medical Condition | avaiable | avaiable | avaiable | avaiable | |

The OneTrip Plus cancellation plan is aimed at domestic travelers seeking travel cancellation, interruption, and delay coverage. Still, it does not need post-departure benefits such as emergency medical assistance or lost baggage. This plan is Allianz’s most affordable option.

As you can see from the table, the three OneTrip Basic, Prime and Premier plans are three complete travel insurance plans.

>>You may also like: How American Express Travel Insurance Works

- OneTrip Basic is the cheapest plan ever and offers benefits for travel cancellation, interruption, and delay along with medical losses and emergency baggage with not too high coverage.

- OneTrip Prime offers all the benefits of the Basic plan but with higher coverage, some extra coverage areas, and free coverage for children under 17 when traveling with a parent or grandparent (this is a very important point if you are traveling as a family).

- OneTrip Premier offers maximum coverage, almost doubling any post-departure Prime plan limit with more covered cancellation reasons.

If you don’t need travel interruption and cancellation protection prior to departure or already have coverage via a premium travel credit card, the standalone OneTrip Emergency Medical plan may be a good choice. The plan primarily provides emergency medical protections along with some lost/delayed baggage benefits.

>> Learn more: AAA Life Insurance Review: What you need to know

Allianz Single Trip Plan Cost

Now that you know the plans let’s see the cost of an Allianz travel insurance policy for a $1,500 week-long vacation in Greece in August 2021, backed by a 30-year-old American.

The cheapest plan is, as we have seen, the OneTrip Basic which costs around $ 50. OneTrip Premier, costing over $100, is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you agree with lower limits for emergency medical care, an OneTrip Prime (around $70) or Basic plan may be a more appropriate choice. These costs represent a range of between 3.4% and 7.5% of the total travel cost, which is very affordable.

>> Learn more: How Do I Get a Refund on Cash App?

Allianz Travel Insurance: Annual/Multi-trip Plans

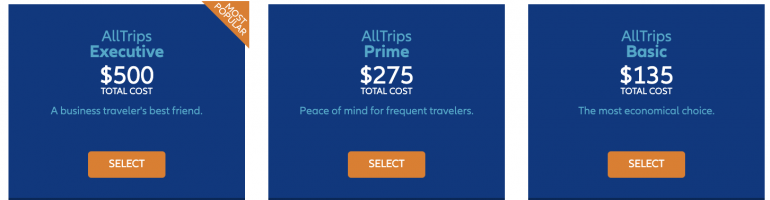

These plans are designed for those who like to take many small trips throughout the year and for business travelers. Allianz Global Assistance offers four different annual/multi-trip plans.

| Coverage | AllTrips Basic | AllTrips Prime | AllTrips Executive | AllTrips Premier |

|---|---|---|---|---|

| Trip Cancellation | $3.000 | $5,000 / $7,500 / $10,000 | $2,000 / $5,000 / $10,000 / $15,000 | |

| Trip Interruption | $3.000 | $5,000 / $7,500 / $10,000 | $2,000 / $5,000 / $10,000 / $15,000 | |

| Emergency Medical | $20.000 | $20.000 | $50.000 | $50.000 |

| Emergency Medical Transportation | $100.000 | $100.000 | $250.000 | $500.000 |

| Baggage Loss/Damage | $1.000 | $1.000 | $1.000 | $2.000 |

| Baggage Delay | $200 | $200 | $1.000 | $2.000 |

| Travel Delay | $600 | $600 | $1.600 | $1.500 |

| Daily Limit | $200 | $200 | $200 | $300 |

| Travel Accident | $25.000 | $25.000 | $50.000 | $50.000 |

| Business Equipment Coverage | $1.000 | |||

| Business Equipment Rental Coverage | $1.000 | |||

| Change Fee Coverage | $500 | |||

| Loyalty Program Redeposit Fee Coverage | $500 | |||

| 24-Hr. Hotline Assistance | ✓ | ✓ | ✓ | ✓ |

| Concierge | ✓ | ✓ | ✓ | ✓ |

| Rental Car Damage & Theft | $45.000 | $45.000 | $45.000 | $45.000 |

| Pre-Existing Medical Condition | avaiable | avaiable | avaiable | |

AllTrips Basic, like its OneTrip Basic sibling, is suitable for those who want emergency medical coverage abroad but do not need benefits such as travel cancellation and interruption. On the other hand, AllTrips Prime, Executive, and Premier plans provide a full year of comprehensive travel insurance benefits with really high coverage.

For trips longer than 45 days, the AllTrips Premier plan may be a better choice as it offers coverage of up to 90 days.

Which Allianz travel insurance plan is best for me?

To choose the right plan for your trip you need to understand the type of coverage you need while abroad.

- If, for example, you have a premium travel card (for example, one of American Express) that already provides you with a sufficient level of travel cancellation coverage, getting the OneTrip Medical plan is certainly sufficient.

- But if you don’t have a credit card or your card won’t put you in no coverage available, then you could choose a full plan such as OneTrip Basic, Prime or Premier.

- Again, if you’re planning on taking multiple, longer trips, the AllTrips Premier plan might be the one for you as it provides insurance benefits for trips up to 90 days in duration.

- The remaining three annual AllTrips plans cover more trips, but up to just 45 days.

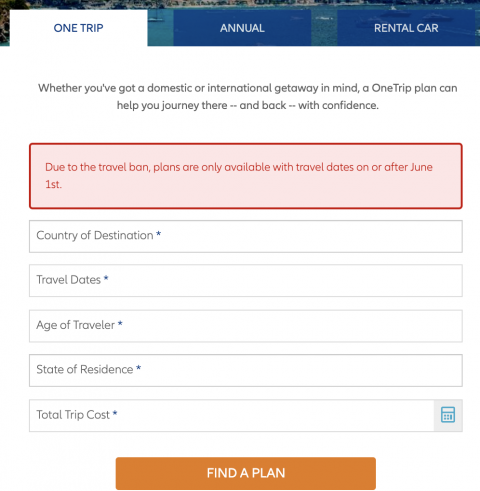

How to choose an Allianz Travel Insurance plan online

To choose your Allianz Travel Insurance plan that is best for you, you will need to follow these simple steps:

- First, you will need to go to AllianzTravelInsurance.com and click on “Find a plan” from the top menu.

- At this point, you will be able to view all plans or see plans classified by a single trip, annual / multi-trip. Once you have decided on the plan you want, click on the “Get a quote” option.

- You will be prompted to enter relevant travel details before seeing which plans are available to you in your state.

What isn’t covered in the Allianz Travel Insurance

Allianz travel insurance plans are not exempt from exclusions. Study what is not covered well to avoid nasty surprises. Here, for example, are the most important exclusions you need to keep in mind:

High-Risk Activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: losses suffered from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and wars are specifically mentioned in the policy as exclusions.

Always keep in mind that most exclusions vary from country to country. So, carefully study the contract they submit to you to clarify all the contractual conditions you are accepting.

Conclusion

Before you leave for your planned trip, it is a good idea to carefully review your different plans and insurance options to make sure you are protected in the event of unpleasant events while traveling.

As you have seen, whether you are a backpacker traveler, a business traveler, or a family man who wants to spend a quiet week at the beach with his wife and children, Allianz Global Assistance offers several plans to choose the one that suits you best.