So what do you need to know about the Nationwide Gap Insurance?

This is an auto insurance settlement that is based on the car’s actual cash value (ACV) and not on what that is paid for. This is can only be done when the car is totalled in an accident or stolen but not recovered.

There is also an exception, due to how depreciation nature of cars, settlement may not necessarily cover what is being owed on an auto loan or lease.

However, this could leave you with no car and a big bill to pay which is why Nationwide’s gap coverage is here to help you avoid this calamitous situation.

Table of Contents

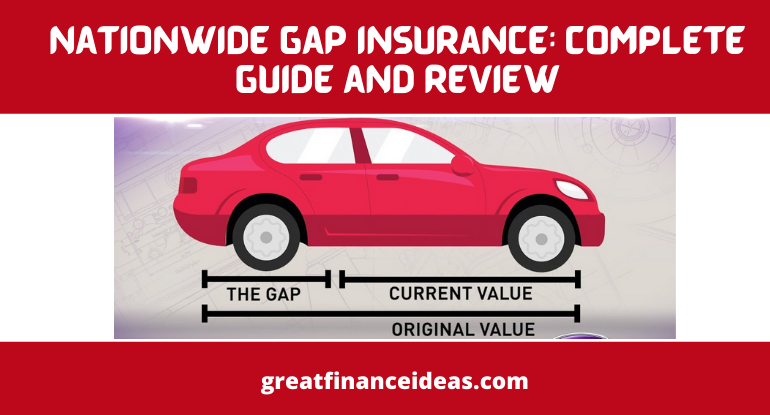

What is gap insurance?

As the name implies ‘Gap’ insurance offers are meant to close the gap between the amount drivers owed on their car and the car’s actual cash value (ACV) in case of an accident.

A car’s actual cash value is that monetary value at the time of the accident and not the car’s original price.

Gap coverage adds more protection to your auto policy

This coverage is optional especially for vehicles that are new and meant to be included in your collision insurance policy.

This payment is meant to augment the difference in the balance of either a lease or loan due on a car and what the insurer pay to cover the total loss.

This can be reasonable without proper coverage in case of the gap between what is being paid and what is owed.

Read also: Infinity Insurance: Ultimate Review for Car, Home and Life Insurance

Your lender may require gap insurance

It will interest you to know that a lender may need loan gap insurance as an add-on to your collision and comprehensive coverage in case your vehicle is financed with a car loan.

This is because a lease gap might have been included in the cost of your vehicle is leased. Always refer to your coverage paperwork for clarification.

Actual cash value determines how much your policy pays

The actual cash value is determined when your car is insured with standard comprehensive and collision insurance policies.

This helps pays for the replacement of your vehicle provided it covered total loss to the limit the policy is insured on the car’s actual cash value.

The ACV is evaluated as the cost of a new car subtracting depreciation for its age, mileage, physical and other conditions.

The actual cost value of your vehicle can cost less than what you paid thereby making your loan or lease balance expensive after a year.

Though, this Nationwide Gap Insurance coverage could be in part or full of the cost. You can find this in selected states for vehicles of 6years old or less.

You may also like: Understanding Comprehensive Insurance in Total: Full Review and Guide

What does gap insurance cover?

Gap Insurance covers damages on a vehicle due to theft but not including other property or bodily injuries recorded as a result of an accident.

Key information regarding gap insurance coverage.

- Does gap insurance cover theft?

Absolutely yes, gap insurance coverage is applicable in event of theft and the vehicle is unrecovered.

- Does gap insurance cover deductible costs?

The Gap Insurance policy does not cover the deductible costs. This is to say, in any accident situation covered by this policy, be prepared to pay your deductible while the insurer pays the difference to cover up the damage.

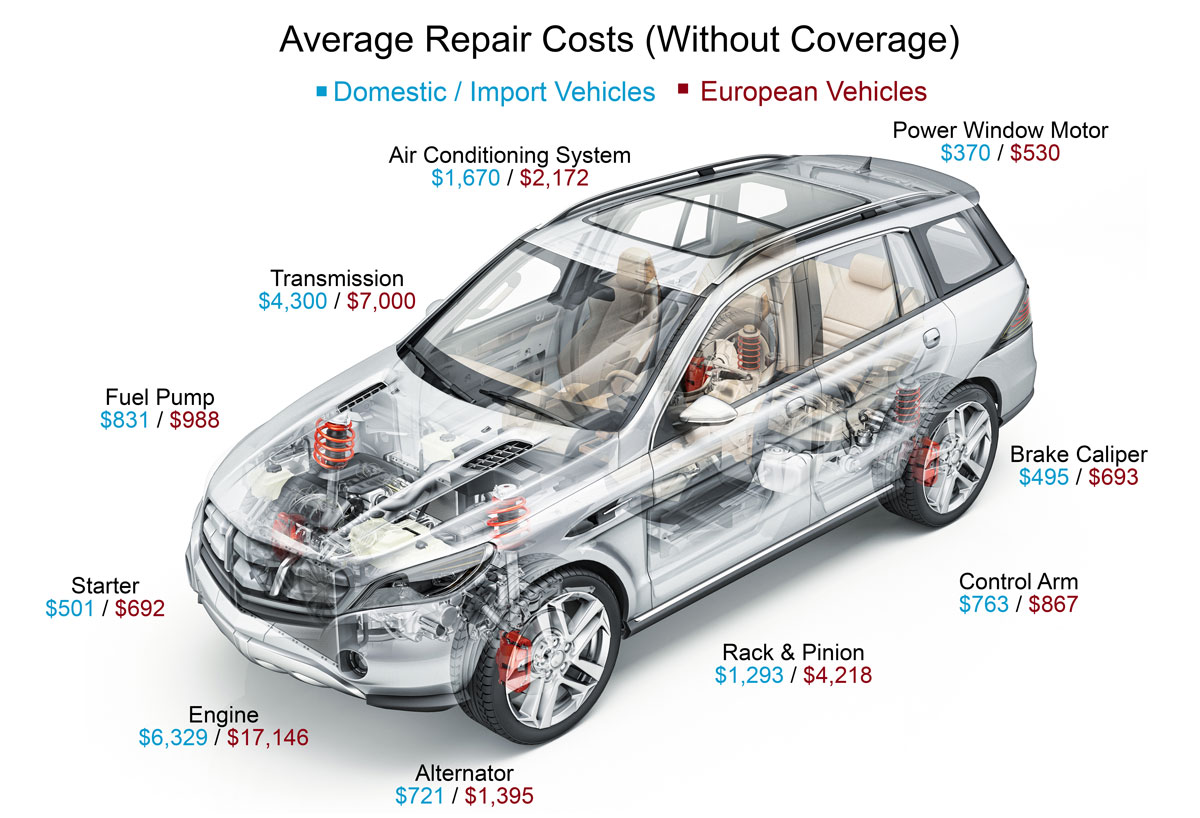

- Does gap insurance cover engine failure?

Not at all, Gap insurance is only concerned with a total loss from covered accidents excluding mechanical repairs.

- Does gap insurance cover death?

No, only vehicle losses are covered excluding bodily injuries, medical expenses, lost wages or funeral costs.

- Does gap insurance cover negative equity?

Obviously, it does, for negative equity is a concept used by the gap to define what you owe on your auto loan and the car’s actual value.