RiverSource is a child brand of Ameriprise Financial, a finance company offering financial planning, investment and other financial products. However, in addition to the more usual financial products, RiverSource also offers term life insurance and a wide selection of universal and variable life insurance, sold directly through Ameriprise’s consultants. Today we’re gonna talk about RiverSource life insurance.

Table of Contents

RiverSource life insurance

In this post, we’ll take a deep dive into the RiverSource life insurance options and we’ll offer you a detailed review of this life insurance in order to let you choose the option that suits you the most.

RiverSource life insurance policies

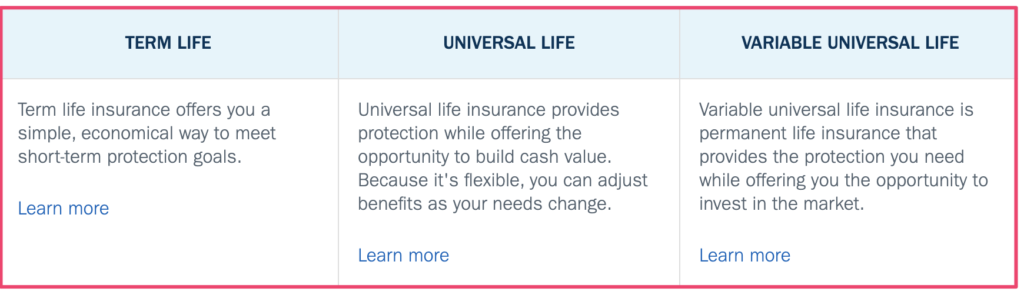

Term life insurance: policies with different terms of 10, 15, 20, and 30 years are available. The annual price remains unchanged for the entire period. In the first five years of the term or at the age of 65, whichever comes first, you can convert the term life into one of the company’s permanent policies.

Keep in mind that, alternatively, when purchasing a policy, you can pay extra for the conversion option until the end of the term or at the age of 65, whichever comes first.

In addition to the basic policy you will be able to add additional add-ons, known as bikers, which is available for a lifetime for a fee, including:

- Premium waiver, which waives the policy premium in case of disability of the insured.

- Accidental death, which pays an additional benefit in the event of death due to an accident

- Child insurance, which provides coverage for your children under the same policy.

>>> You may also like: Guide to Chase Business Checking Accounts [Complete, Performance, Platinum]

Universal Life: You can also choose from a wide selection of universal life policies, including indexed universal life, which ties the growth of the policy’s cash value to an index, such as the S&P 500. This option may be the choice of some finance fanatic who, however, does not know very well how to deal with the markets or not just familiar with insurance policies. The company also offers Universal Life which can provide monthly payments for long-term care.

Variable Universal Life: In this case, you will be the one to choose how to invest the cash value of the policy. You can create a custom portfolio from a wide selection of investment options or choose from one of five professionally managed funds to match your goals and risk tolerance. This is the option for regular or non-entry-level investors.

>>> Learn more also: AIG Life Insurance Review: What you need to know

Children’s insurance and accidental death (if the insured is terminally ill) riders are also available for permanent life insurance. Additional riders include:

- Survivorship life: This type of permanent universal life insurance insures two people with a single policy. The policy pays after the second person dies. Both universal and variable universal life options are available. Usually, it is a type of policy that is chosen by the husband and wife.

- Accelerated death benefit: allows you to access a part of the benefit reserved for death in the event of a terminal illness or chronic illness, allowing you to cover part of the medical expenses that the insured will likely have to bear.

- Waiver of monthly deduction: waive the monthly fee if you are disabled by the age of 65. The amount waived varies according to the age at the time of disability. If you are unemployed, the monthly deduction will be revoked for up to 12 months.

- Waiver of premium: If you have been disabled for at least six months at the age of 65, a specific amount of your reward is revoked or added to your reward. Details vary based on age at the time of disability. If you are unemployed, the premium can be withdrawn for up to one year.

More about RiverSource life insurance

Let’s see the pros and cons of this insurance offert:

| Pros | Cons |

|---|---|

| Preliminary term, universal and long-term care insurance quotes available online. | RiverSource doesn’t provide an app to manage your policy |

| Significantly fewer complaints than expected for life insurance for a company of its size. | Doesn’t sell whole life insurance. |

Conclusion

Well, we hope this article gives you a better review of Riversource life insurance policy. Also, our is that this helps you make a better comparison with other life insurance offers to make a better decision.

We always advise all our readers to take a critical look at the terms of service, and policies of their chosen insurance offer before finally make the purchase.