To know a routing number and account number on a check you first have should be able to ascertain their difference if you see them to be able to use them as supposed.

This article will school you how to go about the whole information involved in how to differentiate and use them both as they are allocated and where to find it on your check.

Table of Contents

What is the difference between Routing Number and Account Number?

Below is the difference between the two financial related numbers:

Routing Number: also known as Routing Transit Number or ABA number it is a nine-digit figure used to identify a particular financial institution (bank) in the United States of America (USA), it shows that the bank is a state-chartered bank that has a reserved account with the USA Federal Reserve.

It also indicates the location and date of your account creation. For checking accounts, a routing number is found on the checks allocated to the bank user.

In a nutshell, routing number importance cannot be overemphasized it is required for every user during e-payment, for direct deposits, tax payment, payment of consumer services and application for new chequebooks, for national and international funds transfers.

You may also like: Can You Cash a Payroll Check at Walmart?

One of the main reasons why you should know a routing number is already listed in the above paragraph, if you do not know yours, create an online account with your bank it is found on it the online account or you can contact the bank which you operate with to get your routing number as the case may be.

Account number: an account number is a unique eight to twelve digit number that identifies every bank user account it is a unique ID with which you can send funds from or receive funds from inter or within the same bank.

This account number is written on checks or found on your online account as well.

The biggest difference between a Routing Number and an Account Number is formal is a unique number that identifies a customer bank while the latter is used to identify every bank account holder.

Where Account and Routing Number is found.

Your account number is first allocated to you once your account opening process is complete and written on your chequebook for checking your account.

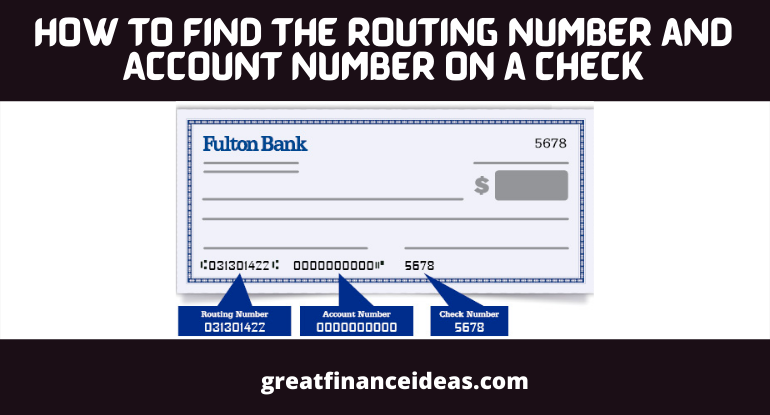

In a Magnetic Ink Character Recognition (MICR) write up found at the button of your check slip is where you can see your routing number, account number and check number.

The first is normally a 9-digit routing number, followed by an 8-12 account number and then your check number.

Tips: In some cases, this array of the routing numbers, account number and check number may not be followed as explained, so simply reach out to a customer care representative to help you ascertain the differences.

Check out also: Saving vs Checking Account: Understand the Difference

Use the Correct Routing Number

Some banks have more than one routing number so as earlier stated to make sure you are using the right one, ask your bank customer representative to know the one meant for you because you can use the two of them together.

Although some banks allow the two different routing numbers, especially while doing direct deposits, ACH transactions and funds transfers.

That is why it is necessary to confirm with your bank the correct number to use when making electronic bill payments and or wire transfers.

SUMMARY

We hope you can now differentiate between a routing number and an account number, where it can be found and when to use it.

The routing number is 9-digits, account numbers 8 and 12 digits.

Was this article helpful?

Leave a comment and subscribe