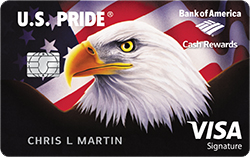

U.S. Pride credit card is offered by Bank of American (BOA) as one of the many cards they offer, it has many benefits like zero annual fees that give card users cashback for their purchases and low balance transfer fees.

Well just like the majority of credit cards, the U.S Pride Credit card is given to those with a good to excellent credit score of at least 670 to 850.

Read Also: How To Find The Routing Number And Account Number On A Check

Table of Contents

How to Apply for a U.S. Pride Credit Card Online

Below are the steps to follow and apply for your U.S Pride Credit Card online;

- First load their official application site here at www.bankofamerica.com.

- Tap on the “Apply Now” button on the first page.

- Write your full names, residential address, but if you have a different mailing address, navigate to the box next to “Send my statement to a different address.” and click on it add it.

- Write your phone number and then type of phone that you posses

- Provide your email address.

- Answer the citizenship question as prompted and select your country of residence.

- Next you will be required to write your date of birth, add employment status, total annual income and source of income.

- Add the number of liquid assets and note the total amount in your checking and savings accounts, stocks, CDs, and money market accounts.

- Write your monthly housing payment amount also add a balance or add a cardholder if you want to transfer balance.

- Agree to the terms and conditions as requested.

- Tap on “Continue” button and follow the instructions to complete your application.

Other Ways to Apply for a U.S. Pride Credit Card

- Apply for a US Pride Cash Back Credit Card via phone call with 1-800-932-27-75

- Go to any of the U.S pride credit card branch close to you or visit their local website application site at location.bancoformerica.com and apply.

U.S. Pride Credit Card Reward Program.

The detailed benefits and rewards for this U.S. Pride Credit Card cardholders range from 3% cashback on Gas, Dining, Online shopping, Drug stores, Travel, Home improvement, and furnishing also, a 2% cash back at grocery stores and wholesale clubs which allows the cardholder to have a good credit score record and this card has a 0% annual fee.

This U.S pride credit card comes with a $200 reward which is activated once the user spends up to $1000 within the first 90-days of acquiring the card.

Read Also: Toyota Financing: Loans, Limitations, CashBacks And Toyota Care

U.S. Pride Cash Back Credit Card FAQs

Does the U.S pride credit card have an annual fee?

There is a 0% annual fee applied for a U.S. Pride credit card.

Is there any intro APR?

The US Pride Credit Card offers a 0% APR for the first 15 billing cycles for balance transfers within the 60 days of the account opening.

What is APR for a U.S. Pride credit card?

This depends on the user’s credit score and it is from the range of 13.99% to 23.99% based on creditworthiness.

Can I transfer a balance with my U.S credit card?

You can transfer a balance for a fee of 3% per transaction which is not less than $10.

NOTE: Before you apply for a balance transfer, calculate your total interest rate, monthly payments, the total cost of your credit card, and the total savings before transferring the balance on your U.S pride credit card, or it may cost you a fortune.

Can I use the U.S. Pride credit card for foreign purchases?

Yes, you can use your U.S. Pride credit card for foreign transactions.

Foreign transactions cost 3% of the total amount per transaction for other currencies, and transactions processed outside of the US.

Was this article helpful?

Leave a comment and subscribe for more.